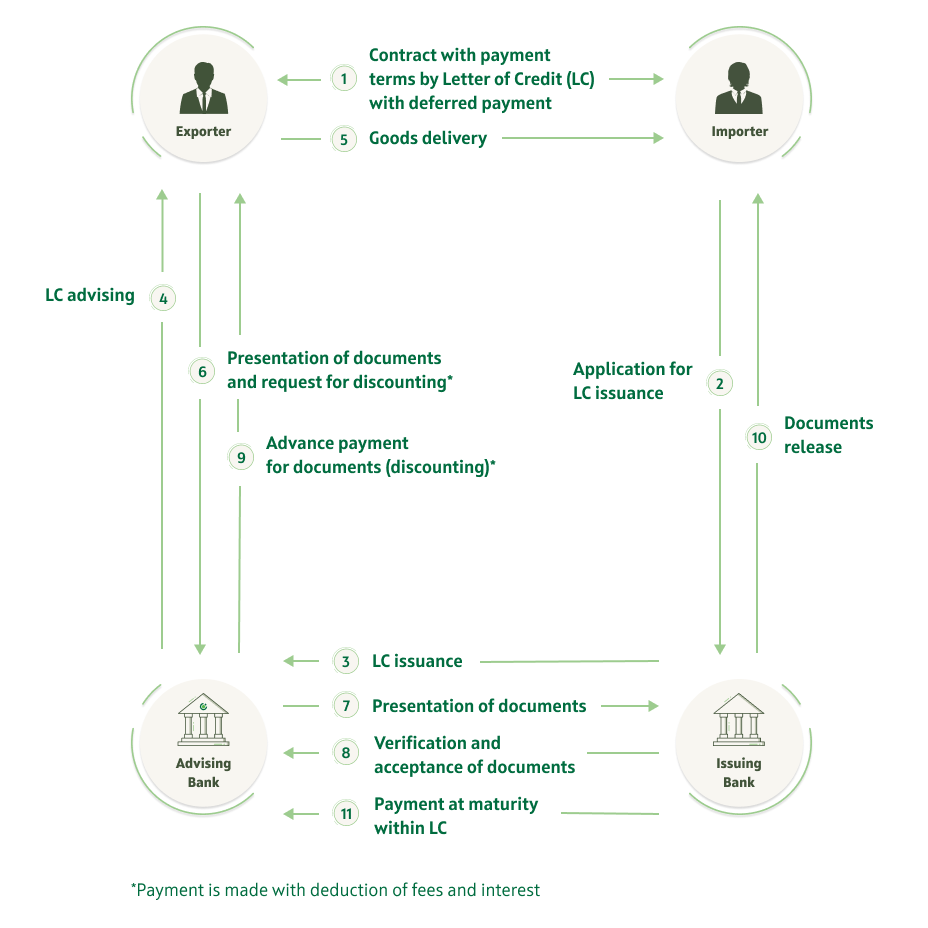

Discounting of a letter of credit is a post export financing transaction (without recourse) for the exporter; the bank buys the value of the documents presented in conform to a Letter of Credit with deferred payment terms and make payment to the exporter’s account before maturity.

What conditions are required for discounting of a letter of credit?

Request to the Buyer payment terms by Letter of Credit with deferred payment terms, issued or confirmed the Letter of Credit discounting and receive money before maturity.

Your advantages

- You may collect the receivable before the maturity date

- You can propose goods and services with payment after delivery

- You receive financing in the amount of up to 100% of the value of the letter of credit

- You benefit from a fast and simple process:

- No mortgage, credit agreements or thorough analysis of exporter’s financial condition

- You gain the reputation of a trustworthy partner that can offer extended payment terms to its clients

.jpg)