More information

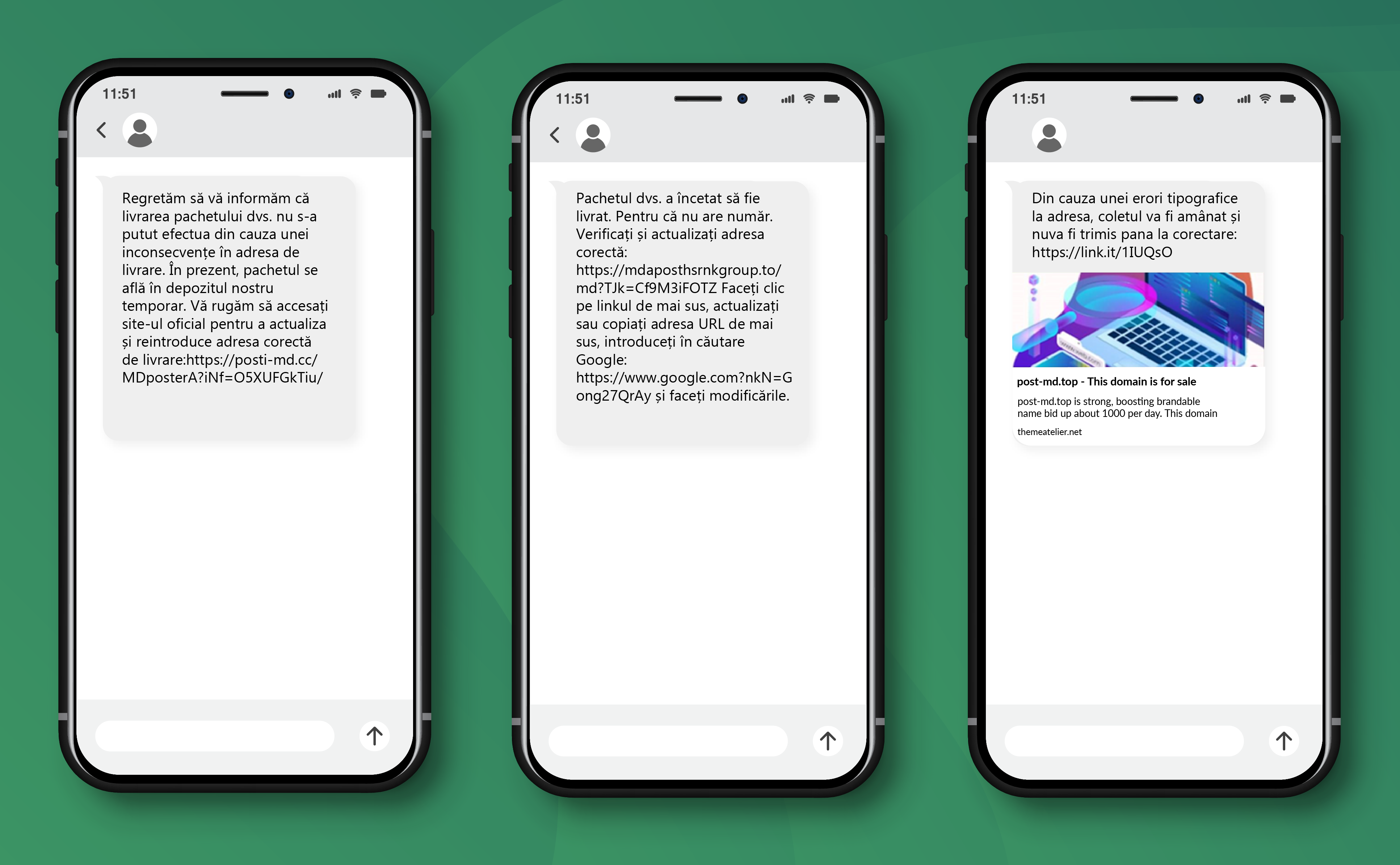

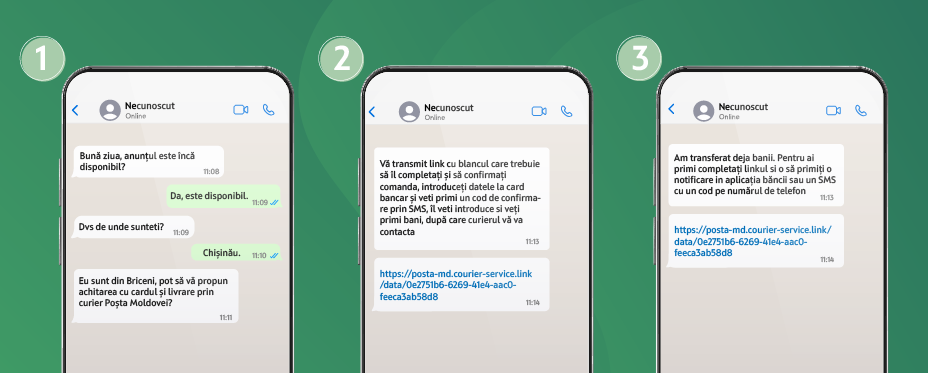

Fraud cases aimed at obtaining bank card details occur through social media, phone calls and websites that sell goods.

Scammers may pose as representatives of the bank or other reputable companies, and send messages requesting your bank card details (16-digit number, CVV security code shown on the back of the card, expiry date, passwords received via SMS/email) under various pretexts: participation in raffles, surveys, competitions or to purchase products online at a reduced price, etc. Once the criminals have obtained the requested data, they take possession of the funds and carry out P2P transfers or other fraudulent transactions, thus harming cardholders.

Show maximum caution and treat with suspicion:

- Incoming calls (by phone, messaging services: Viber, WhatsApp, Telegram, etc.);

- Calls or messages received from potential buyers of products placed on marketing sites;

- Calls or messages received from people close to you requesting bank card details;

- Other fraud schemes such as: participation in sweepstakes, purchase of products online at a reduced price, surveys, contests on behalf of the Bank or other well-known companies.

Important

- Do not give your security passwords, card details or other confidential information to anyone under any pretext, even if the people requesting them are relatives or are posing as bank employees;

- Treat with suspicion any call requesting personal data, even if the phone number or number resembles that of OTP Bank. Discontinue the call and notify the Bank immediately;

- Access only websites you know, pay attention to the ads that appear on social networks, check reviews and the name of websites;

- Watch out for pop-up windows that open automatically when you visit certain sites. As far as possible, set your browser settings to block pop-ups

- Don't make payments to merchants you don't know, haven't checked out or who look suspicious!

If you have been the victim of a fraud attempt, inform us as soon as possible and ask for your card to be blocked. We urge you to write to us directly by clicking on the green button below.