Be independent and start learning how to manage your money from school age with OTP Bank’s first children’s bank card.

The OTP VISA Junior card is a convenient and practical payment tool that gives you the freedom to pay anywhere quickly, without stress or carrying cash. Whether you're shopping online, paying at stores, or simply saving for your dream, the VISA Junior card puts it all within reach.

If you’re between 7 and 17 years old, don’t miss out on being the coolest among your classmates and friends with the VISA Junior card.

Why it’s perfect for you:

- You own your personal card and manage your own pocket money

- Quick and secure payments worldwide with just one tap

- No usage or maintenance fees for the card or account

- 1% floating interest on the account balance—grow your savings with easWhy it’s ideal for parents:

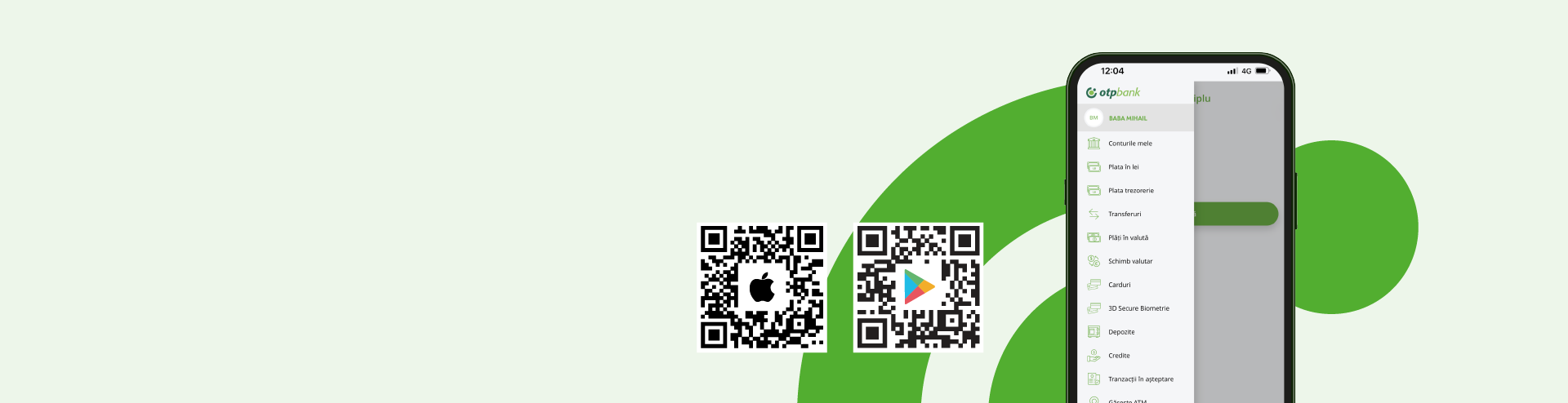

- Real-time tracking of all your child's transactions through the OTP Mobile Banking app

- Your child has secure access to pocket money on their own card

- Peace of mind thanks to restrictions on suspicious transactions

- Top-up the card easily and for free via OTP Mobile Banking, MIA Instant Payments, cash-in ATMs, or any OTP Bank branch

- Helps your child become more financially educated from an early age